總 經(jīng) 理:杜子曦

銷售熱線:0797-8385851

移動(dòng)電話:13627075998

銷售副總:廖輝

銷售熱線:0797-8382735

移動(dòng)電話:13677079889

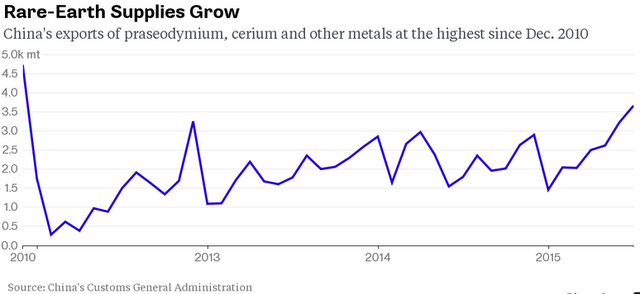

Rare earths have become less rare, which can be attributed to China's rare earth policy. According to official data, China's rare earth exports doubled year-on-year in July, reaching the highest level in over four years. Last year, China lifted its 15 year long rare earth export control, and in April of this year, it also lifted rare earth export tariffs. Since then, the export volume of rare earths has increased.

The supply of rare earths has increased.

According to data from the General Administration of Customs of China, China exported 3658 tons of rare earths in July. China's rare earth production accounts for over 80% of global production.

This trend has been brewing for some time, "said Kevin Stark, an analyst at CRT Capital Group. This is because China has terminated its export quota policy. If China's demand for rare earths decreases, which seems to be the case on the surface, rare earths will leave this place through exports. This is the result of multiple factors working together“

Like other commodities, rare earth prices have been declining. According to Stark, the decline in rare earth prices will further worsen. China is a major consumer of raw materials and its economy is experiencing particularly slow growth for a quarter of a century.

Columnist MYRA P. SAEFONG stated in an article on MarketWatch that China's dominant position in the rare earth market has been consolidated, and opportunities for overseas mergers and acquisitions have matured. The role of China's resource tax reform will eventually be realized, and favorable changes in supply and demand fundamentals may indicate that rare earth and rare earth stock prices have reached dawn, and the several year bear market is about to end.

Handwig recalled that in 2009, China reduced the export of rare earths, driving their prices higher, and creating a foam in the shares of rare earth mining companies.

The sharp decline in rare earth prices has had a significant impact on some companies. Molycorp Inc., a rare earth producer in the United States, filed for bankruptcy protection in June as the company has run out of cash.

Handwoge believes that China wants to maintain its "rare earth monopoly" position, so they are lowering prices and forcing competitors to withdraw. However, it is completely imaginable that rare earth prices will rise again as competitors continue to close or go bankrupt.